Despite President Trump’s last-ditch effort to galvanize support amongst House Republicans, the future of his Trump tax bill hangs in the balance, highlighting deep divisions within the party. The bill, a centerpiece budget plan promising significant tax breaks, has encountered unexpected headwinds from within the GOP ranks. Disagreements over proposed healthcare changes and the handling of state and local tax (SALT) deductions are threatening to derail the legislation, which includes approximately $4.9 trillion in tax breaks. This article will break down the major sticking points causing Republican opposition to the Trump tax bill and analyze its prospects amidst internal strife.

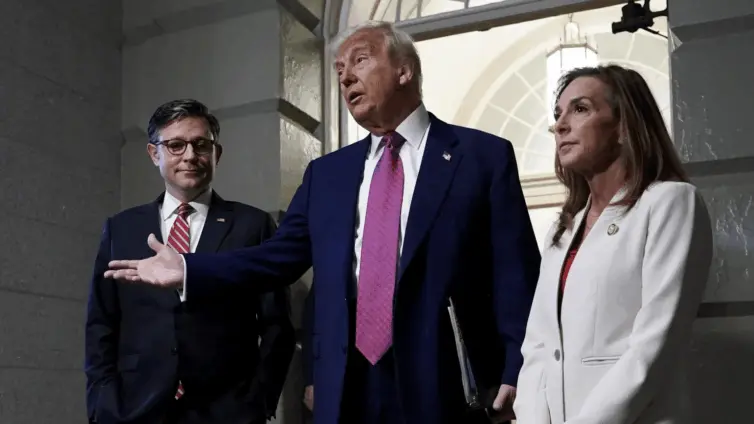

Last week, Trump traveled to Capitol Hill, hoping to unify Republicans behind the bill.

“This was a meeting of love; there was great unity in that room,” Trump declared, portraying a picture of Republican solidarity that belies the reality on the ground. While some Republicans voiced support for Trump’s pitch, others remained unconvinced, setting the stage for a potentially contentious vote. Congressman Mike Lawler was very clear regarding his stance. “As it stands right now, I do not support the bill,” Lawler stated, underscoring the challenges the bill faces. The bill must pass both the House and Senate, and significant challenges await.

The SALT deduction issue has emerged as a major point of contention within the Republican party. State and local tax (SALT) deductions allow taxpayers to deduct certain state and local taxes from their federal income tax. The current Trump tax bill proposes tripling the allowable deduction. This issue has created a rift between Republicans from high-tax states like New York, California, and New Jersey, and their counterparts from states with lower tax burdens. Lawmakers from high-tax states argue that a higher cap will provide much-needed relief for middle-class families in their districts. “While I respect the president, I’m not budging on it,” said Mike Lawler, illustrating the firm stance of some Republicans on this issue.

Republican leaders are seeking compromises to bridge this divide, but concerns remain. “They’re fighting for their districts, and they should be, but when it comes time to vote for the bill, it’s get the best deal possible and vote for the bill,” said Congresswoman Nicole Malliotakis. However, achieving a compromise that satisfies all factions within the party remains a significant challenge.

Another major point of contention is the proposed cuts to the healthcare program, Medicaid. Specifically, the bill would require that states deny Medicaid coverage if able-bodied Americans using the programme are not working at least 80 hours a month. This issue has exposed conflicting views on the appropriate level of government support for healthcare, with some Republicans supporting tighter eligibility requirements and others fearing that the cuts go too far. Representative Andy Harris, representing hardliners, said, “The president I don’t think convinced enough people that the bill is adequate the way it is.”

The Trump tax bill recently faced a procedural hurdle when it failed in an initial committee vote, but it subsequently passed after adjustments. Despite this progress, Trump is now actively lobbying Republicans as the bill heads for a full House vote, where his party holds a narrow majority and cannot afford to lose support. Trump needs to lobby Republicans to avoid Republican opposition to the Trump Tax Bill.

The path forward for the Trump tax bill remains uncertain. Even if it passes the House, it will face further challenges in the Senate, where the margin for error is even slimmer. Ultimately, the fate of the bill will depend on whether Republican leaders can bridge the deep divisions within their party and forge a consensus that can garner enough votes to pass both chambers of Congress.

In conclusion, the Trump tax bill faces significant obstacles due to disagreements over SALT deductions and proposed healthcare cuts. The deep divisions within the Republican party and the uncertainty surrounding the bill’s future remain. The Republican opposition to the Trump tax bill may be a hindrance.

Image Source: MYJOYONLINE