Ama Serwaa knew she wanted something different for her children. Growing up with limited opportunities, she envisioned a future where her kids could pursue their dreams without financial constraints. This Mother’s Day, as Standard Chartered Bank celebrates the invaluable contributions of mothers in Ghana, the spotlight shines on a critical aspect of securing that future: legacy planning. This article explores the importance of building a financial foundation for future generations and how Standard Chartered is empowering Ghanaian families to achieve their goals.

Honoring Mothers and Reflecting on Their Resilience

Standard Chartered’s recent Mother’s Day event wasn’t just a celebration; it was a moment of reflection. The gathering brought together a diverse group, from young professionals navigating the complexities of early motherhood to seasoned matriarchs sharing wisdom gleaned over decades. The atmosphere buzzed with conversation, laughter, and a shared understanding of the multifaceted roles mothers play within families and communities.

Beyond the bouquets and heartfelt speeches, the event served as a potent reminder of mothers’ enduring resilience. Standard Chartered recognized that mothers are not only caregivers but also often the financial backbone of their families, making critical decisions that impact generations to come. The day provided a perfect setting to explore the themes of future financial security and what steps are necessary to ensure it.

The Importance of Financial and Generational Planning

The core message of the Mother’s Day event went beyond mere celebration; it underscored the critical importance of planning for the future, both financially and generationally. Mothers often face unique challenges in balancing immediate family needs with the imperative of securing long-term financial stability. Questions surrounding wealth management, education funding, and ensuring a comfortable retirement are constantly present.

What is Legacy Planning and Why Does It Matter for Mothers?

Legacy planning, in this context, transcends simple financial management. It’s about strategically building a lasting financial foundation for future generations. It encompasses everything from estate planning and succession strategies to philanthropic endeavors, empowering mothers to create a lasting positive impact on their families and communities. For mothers in Ghana, legacy planning provides the framework to address the unique challenges and opportunities present in the local economic landscape, ensuring that their hard work and dedication translate into lasting prosperity for their children and grandchildren.

Standard Chartered’s Wealth Management Solutions for Lasting Legacies

Standard Chartered recognizes the complexities of wealth management and is dedicated to helping clients grow, protect, and effectively transfer their wealth. With a suite of tailored wealth management solutions, the bank empowers individuals and families to build sustainable financial legacies designed to withstand the test of time. These solutions encompass a range of services, including education planning, ensuring children have access to quality education; retirement savings, helping individuals secure a comfortable and dignified retirement; and strategic investments, maximizing wealth potential while mitigating risk.

With experience advising multi-generational families, Standard Chartered understands the nuances of preserving and growing wealth across generations. The bank’s global presence, coupled with its deep understanding of the Ghanaian market, positions it as a trusted partner for families seeking to build lasting financial security. This local expertise allows for the creation of tailored strategies that align with the unique cultural and economic realities of Ghana.

Building a Secure Future with a Trusted Financial Partner

Standard Chartered is committed to providing comprehensive and tailor-made financial solutions to its clients in Ghana. The bank sees itself as a reliable partner, offering guidance and support as clients navigate the complexities of financial planning. By providing access to services like education planning, retirement savings, and diverse investment opportunities, Standard Chartered empowers its clients to make informed decisions that contribute to building a secure and prosperous future for themselves and their families. Strategic financial planning, with the support of a trusted partner, is the cornerstone of a lasting legacy.

In conclusion, legacy planning is an essential consideration for mothers and families in Ghana seeking to secure their financial future and create lasting positive impact. Standard Chartered is dedicated to empowering its clients to achieve their financial goals and build a brighter tomorrow for generations to come. Learn more about Standard Chartered’s wealth management solutions and start planning your legacy today by visiting your local branch or contacting a Standard Chartered financial advisor.

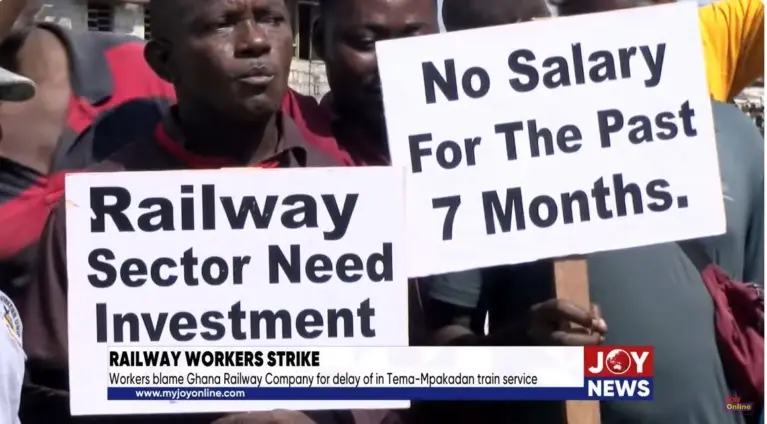

Image Source: MYJOYONLINE