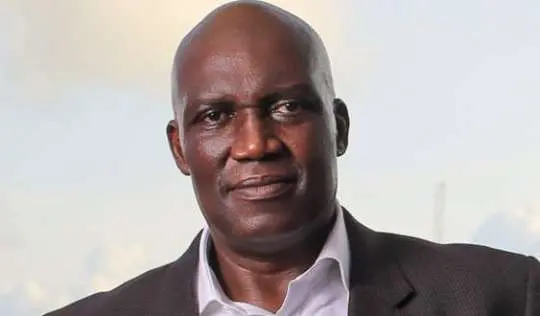

In recent months, Ghana’s economy has shown signs of resilience, with the cedi experiencing relative stability against major currencies. However, economist Professor Godfred Bokpin is raising concerns about the nation’s currency strategy, suggesting that the current approach prioritizes exchange rate management over the crucial accumulation of Ghana’s reserves. This, he argues, could undermine long-term macroeconomic stability.

The Finance Ministry and the Bank of Ghana have been working in tandem, implementing coordinated measures aimed at stabilizing the economy. These efforts include expenditure-based consolidation and monetary tightening.

Prof. Bokpin contends that while these measures may yield short-term gains, Ghana risks sacrificing its long-term economic health by focusing too heavily on manipulating the exchange rate instead of bolstering its foreign reserves.

Understanding Ghana’s Current Economic Strategy

The government’s stabilization efforts are multifaceted, involving close collaboration between fiscal and monetary authorities. As Prof. Bokpin notes, “There’s coordination going on toward a common goal. From the fiscal side, there is expenditure-based consolidation. Government is not spending. And from the monetary side, there’s tightening.”

Favorable FX inflows are being strategically deployed to manage the exchange rate, potentially with the motive of artificially suppressing inflation. This currency strategy raises questions about sustainability and the true cost to the broader economy.

Prof. Bokpin’s Concerns: A Critical Analysis

Prof. Bokpin argues that the current approach, while seemingly effective in the short term, is ultimately unsustainable. Building Ghana’s reserves is paramount for ensuring long-term macroeconomic stability, providing a buffer against external shocks and fostering investor confidence.

“My suspicion is that the central bank is looking at how to drive down inflation from the point of view of exchange rates. But that is not sustainable. We should be building reserves. Not playing with rates,” Prof. Bokpin stated, emphasizing the need for a more prudent and forward-looking approach.

A stronger cedi, achieved through exchange rate manipulation, can make imports cheaper, which, while benefiting consumers in the short run, disadvantages local producers. This, according to Prof. Bokpin, does not support job creation and hinders the development of domestic industries.

“That strategy does not create jobs… From November 2023, inflation on locally produced goods is higher than imported inflation. That should worry us. You’re better off importing and paying all the port duties than producing locally,” he explained, highlighting the perverse incentives created by the current currency strategy.

Prof. Bokpin suggests that the authorities are over-relying on exchange rates because of an inability to effectively address supply-side constraints. He advocates for supply-oriented policies and reforms that can enhance productivity and competitiveness.

“If the consideration is that we can’t fix supply-side constraints, and so we focus on reducing demand, then I disagree with this approach. We need supply-oriented policies. What we are doing now does not coexist with supply reforms,” he asserted.

The Need for Stability and Predictability

Uncertainty in exchange rate targets can be disruptive to businesses and investment. Stability is crucial for planning and investment decisions, enabling businesses to operate with confidence and clarity.

“The market has adjusted largely to ¢15 to $1. If you now drag it down further, to what end? What level is the Bank of Ghana targeting? That hasn’t been communicated. And that uncertainty can be disruptive,” Prof. Bokpin cautioned.

Ghana should seize the current window of calm to accumulate Ghana’s reserves, which would provide a buffer against future economic volatility and support long-term cedi stability.

“What the market needs is stability. Not spikes and crashes. Stability. We should rather build our reserves… That allows predictability. That allows planning. That allows the cedi to be stable over the next 10, 15, 20 years,” he stated.

Risks and Cautionary Notes

While acknowledging agreement with the First Deputy Governor’s claims, Prof. Bokpin warns against complacency and highlights the risk of breaching the IMF programme floor.

“Yes, we’re not below the floor set under the IMF programme. But we’ve breached that floor before—before the elections. So there’s a risk,” he cautioned, underscoring the need for vigilance.

It is crucial to avoid sacrificing long-term resilience for short-term gains. Policies must be sustainable over time, ensuring that the benefits are not fleeting and that the economy remains robust in the face of future challenges.

“Anytime the cedi strengthens, the real issue is: can it be sustained? If it can’t, then it creates volatility. And that is not good for planning, not good for business, not good for investment,” Prof. Bokpin concluded.

In summary, Prof. Bokpin’s analysis suggests that Ghana’s currency strategy, which currently prioritizes exchange rate manipulation over building Ghana’s reserves, could jeopardize long-term macroeconomic stability. He urges policymakers to adopt sustainable policies that support lasting economic resilience.

Image Source: MYJOYONLINE