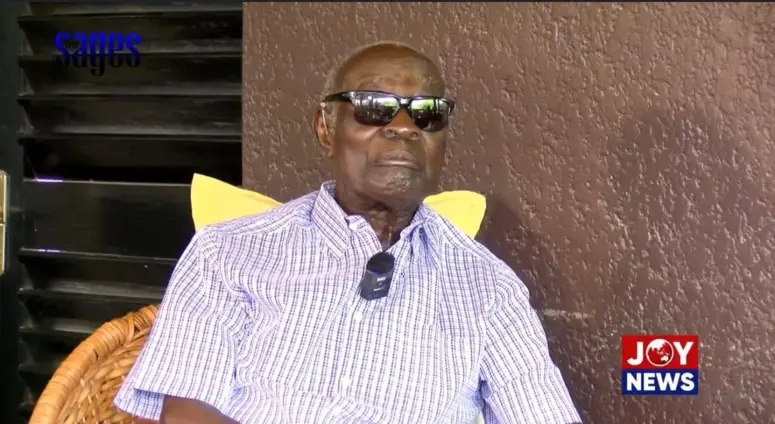

The Ghanaian Cedi has seen its share of ups and downs recently, sparking lively discussions about what’s truly driving its stability. Amidst this debate, Dr. Abdul Kabiru Tiah Mahama, a Member of Parliament deeply involved in the Finance Committee, has stepped forward to challenge some of the prevailing narratives. Specifically, Dr. Tiah is questioning claims made by the Deputy Finance Minister regarding the impact of the newly established Gold Board on the Cedi’s recent performance. This comes at a time when economic debates are already heated, particularly after challenges posed by figures like former Vice President Bawumia. The question is: what’s really behind the Cedi stability?

Dr. Tiah argues that attributing the Cedi’s earlier appreciation to the Gold Board is premature at best, and misleading at worst. He suggests that pre-existing structures, such as the Precious Minerals Marketing Company (PMMC), deserve more credit for laying the groundwork. The MP’s perspective offers a nuanced look at the complexities of currency stability in Ghana and warrants a closer examination of the facts.

Deputy Finance Minister Thomas Nyarko Ampem recently suggested that the Gold Board has played a significant role in boosting gold export revenues, leading to increased Cedi stability. He cited impressive figures, claiming an increase from $860 million in the first quarter of 2024 to over $2.7 billion in the same period of 2025. These numbers paint a compelling picture of the Gold Board’s potential impact on the Ghanaian economy.

However, Dr. Tiah offers a crucial counter-argument: timing is everything. He points out that the Gold Board only became operational in late March 2025. “You heard the explanation from my respected colleague, the Deputy Finance Minister — they are pointing to the Gold Board,” Dr. Tiah stated. “But the fact is, there was no Gold Board in January or February.” This timeline directly contradicts the notion that the Gold Board could have been the primary driver of the Cedi’s appreciation in the earlier months of the year.

Dr. Tiah elaborates, emphasizing that the Cedi’s appreciation predates the Gold Board’s existence. “So they should discard the Gold Board factor,” he asserts. His argument rests on the fundamental principle that correlation does not equal causation. Just because gold export revenues increased after the Gold Board’s establishment doesn’t automatically mean the board was responsible for that increase. Other factors could be at play, making it essential to analyze the situation with a more critical eye.

Before the fanfare surrounding the Gold Board, the Precious Minerals Marketing Company (PMMC) served as the established agency for managing gold exports in Ghana. For years, PMMC has been the primary conduit for gold trade, overseeing the logistical and financial aspects of getting Ghana’s precious metal onto the global market. The PMMC’s role cannot be overstated; it was already a functioning system before the Gold Board came into the picture.

According to Dr. Tiah, the government’s efforts to strengthen the PMMC system laid the groundwork for the recent increases in gold export revenues. “There was already a system in place,” Dr. Tiah explains. “The PMMC predates even the NPP administration. What the NPP did was strengthen that system by directing large-scale mining firms to sell at least 20% of their production to the PMMC, and small-scale miners were also directed to sell to the same company.” This strategic move ensured that a significant portion of Ghana’s gold production flowed through official channels, boosting revenues and potentially contributing to currency appreciation.

Given its recent establishment, the Gold Board essentially took over PMMC’s operations. So far, its impact has been minimal and its role in the initial Cedi stability is at best, overstated. This means that any credit attributed to the board’s influence on the Ghanaian economy and currency stability requires more evidence to support the claims.

Currency stability is a multifaceted issue, influenced by a range of economic factors that extend beyond gold exports alone. Foreign exchange reserves, interest rates, fiscal policies, and investor confidence all play significant roles in determining the value of a currency. Attributing the Cedi’s stability to a single factor, such as the Gold Board, oversimplifies a complex economic reality.

Dr. Tiah concludes by calling for greater accuracy in economic reporting. He urges the government to avoid misrepresenting timelines and to acknowledge the contributions of pre-existing structures like the PMMC. By providing a more complete and accurate picture of the factors influencing the Cedi’s stability, policymakers can make more informed decisions and the public can have a better understanding of the Ghanaian economy.

In summary, Dr. Tiah contends that the Gold Board is unlikely to be the primary driver of the Cedi’s earlier appreciation, given its recent establishment and the PMMC’s established role. He stresses the importance of accurate reporting and recognizing the contributions of existing structures, arguing that currency stability is complex and influenced by a multitude of factors. To truly understand the Cedi’s trajectory, it’s crucial to consider all relevant variables and avoid oversimplifying the narrative.

Image Source: MYJOYONLINE