In Accra, Ghana, a debate is brewing over the country’s economic trajectory. Economist Godfred Bokpin recently voiced concerns that the nation’s current monetary and fiscal policies, while delivering short-term gains such as currency stability and a decline in inflation, might be inadvertently hindering the potential for long-term economic growth. His analysis suggests a need to carefully consider the unintended consequences of these policies, particularly on local businesses and the broader economy. This concern comes at a time when many are looking to Ghana as an example of how to implement sound monetary policy. This article delves into the specifics of Ghana’s monetary policy, its potential pitfalls, and alternative strategies, drawing heavily from Prof. Bokpin’s expert insights shared on Newsfile.

Ghana’s recent economic stabilization efforts are driven by coordinated actions from key financial leaders. The 2025 budget, in particular, signals a deliberate move towards stabilizing what had been an overheated economy. This is being achieved through what Bokpin describes as expenditure-based fiscal consolidation. The figures speak for themselves: government expenditure saw only a nominal increase of just over ¢10 billion compared to 2024, a clear indication of stringent fiscal control. Prof. Bokpin has publicly commended the Finance Minister and the Bank of Ghana Governor for their coordination. “There’s coordination going on towards a common goal. And I want to commend them for that,” he stated.

Complementing these fiscal measures, the Bank of Ghana is enhancing transparency through the publication of minutes from individual Monetary Policy Committee (MPC) members. Furthermore, the policy rate has been raised by 100 basis points, coupled with increased efforts to sterilize and mop up excess liquidity in the market. These monetary policy actions are designed to combat inflation and stabilize the currency.

However, Prof. Bokpin raises critical questions about the sustainability and potential side effects of Ghana’s monetary policy approach, especially concerning the exchange rate. He suspects that the central bank is actively trying to curb inflation by artificially strengthening the cedi, Ghana’s currency. “My suspicion is that the central bank is trying to drive down inflation through the exchange rate. That’s why we’re seeing the currency strengthen,” he noted. While a stronger currency can indeed help tame inflation by making imports cheaper, Bokpin warns that it may come at the expense of domestic production and competitiveness.

“If we keep strengthening the currency, all we’re doing is making imported goods cheaper. That doesn’t help us build anything. It just makes local producers less competitive,” Bokpin cautioned. This strategy, he argues, risks turning Ghana into an import-oriented economy, with limited job creation and a weakened local industrial base. Data from November 2023 indicated that inflation on locally produced items was higher than that on imported goods, even after import duties, further incentivizing reliance on foreign products.

Bokpin proposes alternative strategies centered on boosting domestic production and building reserves. “What we need in that situation are supply-oriented policies. Those won’t coexist with what we’re doing now,” he asserted, emphasizing the need for a shift in focus. Instead of prioritizing exchange rate interventions, Bokpin suggests that Ghana should focus on building up its reserves with favorable foreign exchange (FX) flows.

“With favourable FX flows, we should be building reserves. That allows for long-term predictability. Stability over time is what the market needs. That helps with planning. The ups and downs aren’t good,” Bokpin explained. He believes that building reserves would provide a buffer against economic shocks and create a more stable environment for businesses to plan and invest.

The economist also stressed the importance of clear communication from the government regarding its exchange rate targets to avoid market speculation. “The market has adjusted to around ¢15 to the dollar. If you drag it down, to what point? I believe the Bank of Ghana has a target level in mind. But they haven’t communicated that. And that’s dangerous. It leaves the market guessing,” Bokpin stated.

Sustainability is a key concern, given Ghana’s history of currency appreciation followed by depreciation. “When the cedi strengthens, the real concern is always sustainability. We’ve seen this before. It goes up, it comes down. That’s not good for planning or investment,” he cautioned. A volatile currency undermines business confidence and hinders long-term investment decisions.

In conclusion, Prof. Bokpin’s analysis underscores the delicate balance that Ghana must strike in its economic policies. While the pursuit of stability and lower inflation is commendable, the potential risks to domestic production and long-term growth cannot be ignored. A shift towards supply-side policies, reserve building, and transparent communication could pave the way for a more sustainable and balanced economic future for Ghana, ensuring that the benefits of economic progress are shared more widely and that the nation’s monetary policy benefits all.

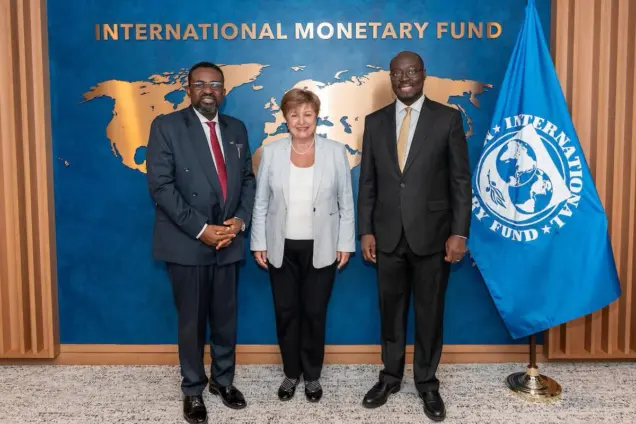

Image Source: MYJOYONLINE