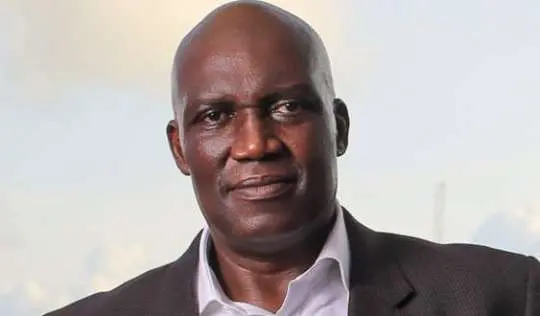

The recent surge of the Ghanaian Cedi against the US dollar has caught many businesses off guard, prompting a mix of relief and concern. Amidst this surprising Cedi Appreciation, Kenneth Thompson, former CEO of Dalex Finance, has issued a warning about the potential pitfalls of celebrating too soon. While a stronger cedi might seem like good news, Thompson suggests that this appreciation may not be rooted in fundamental economic improvements, raising questions about its sustainability and the implications for business planning. His remarks, made on Newsfile, highlight the delicate balance Ghana must strike to ensure genuine economic stability.

The Ghanaian Cedi has experienced notable gains, offering some respite after periods of depreciation. However, Thompson cautions that this positive trend needs careful examination, especially concerning whether it stems from lasting economic reforms or temporary interventions.

Kenneth Thompson’s Concerns About the Cedi’s Appreciation

Thompson’s primary concern revolves around the notion that the Cedi Appreciation isn’t reflective of a substantial shift in Ghana’s economic underpinnings. He argues that without real, fundamental changes, the cedi’s strength might be short-lived. “The fundamentals of this economy have not changed,” Thompson stated. “If they had, you would see a gradual and consistent movement in the right direction.” This lack of fundamental change raises questions about the sustainability of the current exchange rate and its ability to support long-term economic growth. He expressed skepticism about whether the gold-backed support for the currency will be enough to ensure consistent movement, adding that consistent and predictable movement is needed.

Moreover, Thompson questioned the Bank of Ghana’s exchange rate policy, wondering if the central bank is operating within a defined band. “Is it between 12 and 13 cedis, or 12 and 15? I don’t know,” he said. This lack of clarity, according to Thompson, undermines transparency and makes it difficult for businesses to anticipate future exchange rate movements. Clear and transparent exchange rate policies are critical for fostering confidence and stability in the market.

Risks to Businesses Due to Erratic Exchange Rate Movements

One of Thompson’s most pressing concerns is the difficulty businesses face when trying to plan in an environment of unpredictable exchange rates. The Ghanaian Cedi‘s fluctuations can significantly impact budgeting, pricing, and investment decisions, potentially leading to financial instability for many enterprises. “If I’m planning now, what figure do I use? If I get my numbers wrong, my business could collapse,” Thompson cautioned.

For importers and companies with dollar-denominated obligations, the erratic movements of the Ghanaian Cedi pose significant risks. Unexpected depreciations can strain companies that are already managing tight margins, leading to substantial financial losses. Consider an importer who secures a loan in US dollars expecting a certain exchange rate, only to find that the rate has shifted unfavorably by the time repayment is due. Such a scenario highlights the precarious nature of conducting business amidst currency volatility.

Thompson also highlighted the challenges in forecasting costs and revenues, stating, “I don’t know what the rate will be in July or December. This unpredictability makes it hard to forecast costs and revenues.” Without a clear understanding of future exchange rates, businesses struggle to make accurate financial projections, hindering their ability to invest and grow sustainably.

The Call for Strengthening Foreign Reserves

Echoing Thompson’s concerns about stability, Prof. Godfred Bopkin from the University of Ghana Business School emphasized the urgent need to strengthen Ghana’s foreign reserves. According to Bopkin, building up reserves is critical for ensuring long-term economic stability. “What the market is looking for is stability, and we need to build our reserves,” he stated.

Strong foreign reserves can provide a buffer against economic shocks and contribute to greater predictability in the currency market. The Bank of Ghana’s strategy, according to the First Deputy Governor, is not to burn reserves. Stability in reserves often translates to stability in the currency market, providing businesses with a more predictable environment for planning and investment. This sentiment aligns with Thompson’s call for more transparent and predictable exchange rate policies.

In summary, while the recent Cedi Appreciation may appear promising, Kenneth Thompson’s warning underscores the importance of addressing underlying economic fundamentals and promoting transparent exchange rate policies. Combined with Prof. Bopkin’s argument for building foreign reserves, it’s clear that sustainable economic strategies are essential to support the cedi’s value in the long term.

Image Source: MYJOYONLINE