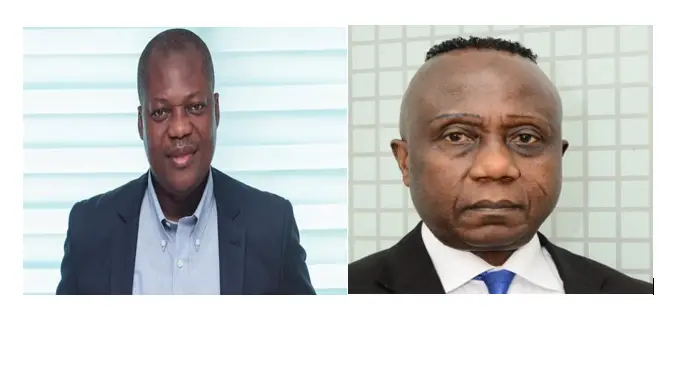

In a move aimed at fortifying its policy-making capabilities, the Governor of the Bank of Ghana (BoG), Dr. Johnson Asiama, has recently appointed Dr. John Gatsi, Dr. John Kwakye, Franklin Belyne, and Dr. Francis Kumah as advisors. The strategic appointments seek to harness the expertise of seasoned economists and banking professionals, providing crucial support to the BoG’s overarching objectives. Addressing attendees at the Monetary Policy Committee Meeting, Dr. Asiama articulated the specific roles each advisor would undertake, emphasizing their individual contributions to pivotal areas, including non-interest banking initiatives and international monetary policy. This in-depth analysis will explore the nuances of these appointments, their anticipated impact, and the wider implications for Ghana’s economic landscape, especially considering the importance of the Bank of Ghana.

Dr. John Gatsi, an economist with a specialization in financial institutions, will focus specifically on advising on non-interest banking initiatives at the Bank of Ghana, according to Governor Asiama’s statement at the Monetary Policy Committee Meeting. This area is increasingly important as Ghana seeks to diversify its financial sector and cater to a broader range of financial needs.

Dr. John Kwakye, the Director at the Institute of Economic Affairs, brings extensive experience in economic policy and analysis to his new advisory role. His insights will likely be crucial as the Bank of Ghana navigates complex economic challenges.

Franklin Belyne, a veteran of the banking sector, previously served as the Head of Banking Supervision at the Bank of Ghana. His profound understanding of banking regulations and supervisory practices is expected to be invaluable in ensuring the stability and integrity of the financial system.

Dr. Francis Kumah, the former Ghana representative at the International Monetary Fund (IMF), also joins the advisory team. Governor Asiama noted that Dr. Kumah “will bring his experience from his working at the IMF to support the Bank of Ghana,” particularly in navigating international monetary policy issues.

Gloria Quartey, former Head of Human Resources, will remain an advisor to the Governor, ensuring institutional knowledge and continuity within the Bank of Ghana.

The appointment of these advisors underscores the Governor’s commitment to evidence-based policymaking. The advisors are appointed to support the Governor in making informed policy decisions for the central bank.

Governor Asiama revealed the appointments at the opening of the Monetary Policy Committee Meeting, indicating the importance of these advisors in shaping future monetary policy.

With expertise in banking supervision (Belyne) and international finance (Kumah), the appointments signal a focus on strengthening financial stability. This could lead to more robust banking regulations and improved management of external economic factors, further securing the Bank of Ghana’s standing.

Dr. Gatsi’s role suggests a growing emphasis on non-interest banking, potentially opening new avenues for financial inclusion and broadening the scope of the Bank of Ghana’s influence.

Dr. Kwakye’s involvement could bring valuable insights from the Institute of Economic Affairs into the BoG’s policy deliberations, providing a fresh perspective on economic challenges and opportunities.

The recent appointment of Dr. Gatsi, Dr. Kwakye, Belyne, and Dr. Kumah as advisors to the Governor of the Bank of Ghana signifies a strategic effort to strengthen the central bank’s operational capabilities. These seasoned professionals bring a wealth of knowledge across diverse domains, spanning banking supervision, international finance, and non-interest banking. Their collective expertise is anticipated to make significant contributions to informed policy decisions, ultimately benefiting Ghana’s economic stability and fostering sustainable growth. The announcement, made at the Monetary Policy Committee Meeting, emphasizes the pivotal role these advisors will play in shaping the future direction of Ghana’s monetary policy. It is hoped that this diverse team of advisors will substantially strengthen the Bank of Ghana’s position within the broader economic landscape.

Image Source: MYJOYONLINE