The announcement by Isaac Adongo regarding stricter regulations on dollar withdrawals in Ghana has ignited immediate discussion and concern. In a move aimed at bolstering the cedi, Ghana’s central bank is implementing new measures that significantly restrict access to US dollars over the counter. This development arrives amidst a backdrop of recent appreciation of the cedi against major currencies, a trend the government is keen to sustain. This article delves into the specifics of these new dollar withdrawal restrictions Ghana, explores the rationale behind them as articulated by Mr. Adongo in an upcoming interview, and analyzes the potential ripple effects for individuals and businesses operating within the Ghanaian economy. These new dollar withdrawal restrictions in Ghana seek to address currency stability concerns.

Understanding the New Dollar Withdrawal Restrictions

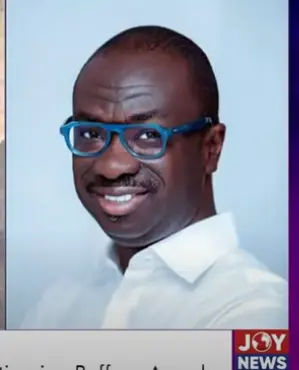

The core of the new policy centers around significantly limiting over-the-counter withdrawals of US dollars. According to Isaac Adongo, a board member of the Bank of Ghana, these restrictions will be stringent, with very few exceptions permitted. The intention is to steer individuals and businesses away from using physical dollars for transactions within Ghana.

“If you put your dollars in the bank account, it is okay…you can only get dollars if indeed you are going to use them for a dollar-denominated transaction,” Mr. Adongo stated, emphasizing that the policy aims to ensure dollars are used for their intended purpose – facilitating international trade and dollar-denominated transactions.

Mr. Adongo has explained that the Bank of Ghana’s decision is rooted in the desire to regulate the use of the national currency and to combat the depreciation of the cedi by limiting dollar speculation. In essence, the central bank wants to encourage the use of cedis for domestic transactions, reserving dollars for legitimate international trade and financial obligations. As Mr. Adongo articulated, “The Central Bank’s role includes regulating the use of our legal tender. When you request dollars, we’ll provide cedis instead.”

These new dollar withdrawal restrictions Ghana will impact a wide range of stakeholders, including individuals, businesses, importers, and exporters. While legitimate foreign transactions will continue to be permitted, the new rules will likely require adjustments in how businesses manage their finances and access foreign currency. Businesses must adapt to these new dollar withdrawal restrictions in Ghana.

The Cedi’s Recent Recovery: Context and Contributing Factors

The introduction of these restrictions comes at a time when the Ghanaian cedi has been experiencing a period of recovery against major currencies. This appreciation follows a period of significant depreciation, and the government is eager to maintain this positive trajectory. The dollar withdrawal restrictions Ghana are part of this effort.

The cedi has shown marked improvement against the US dollar, the British pound, the euro, and the Canadian dollar. While specific exchange rates fluctuate, the trend indicates a strengthening of the cedi in recent months. This recovery is attributed to a combination of factors, including policy interventions and increased export revenues.

One key factor is the Goldbod agreement with mining companies, supported by analysts at Databank Research. Under this agreement, a portion of gold production – approximately 20% – is purchased domestically in cedis. This arrangement increases the demand for cedis, thus supporting its value against other currencies.

Furthermore, Ghana has seen a significant increase in gold export revenues. In January and February of 2025 alone, gold exports generated $2.3 billion. This surge in export earnings has provided a boost to the Ghanaian economy and contributed to the cedi’s appreciation, making the new dollar withdrawal restrictions Ghana a supportive measure. This impressive figure underscores the importance of gold exports to Ghana’s economic stability.

Potential Impacts and Implications

The new dollar withdrawal restrictions Ghana are poised to have a multifaceted impact on the Ghanaian economy. Businesses, particularly those engaged in import and export activities, will likely need to adapt their financial strategies. For example, importers may need to secure cedis to pay for goods, while exporters will need to convert their dollar earnings into cedis.

The long-term sustainability of the cedi’s gains remains a subject of debate. While the restrictions may provide short-term support for the currency’s value, some analysts question whether they represent a sustainable solution. Potential drawbacks could include the creation of a parallel market for dollars or unintended consequences for certain sectors of the economy.

Expert opinions on the new restrictions are varied. Some economists believe that they are a necessary measure to stabilize the cedi and curb speculation. Others express concern about the potential impact on businesses and the overall economy. The effectiveness of these measures will ultimately depend on a range of factors, including the government’s commitment to sound economic policies and the global economic environment.

In summary, the recent announcement by Isaac Adongo regarding the new dollar withdrawal restrictions Ghana represents a significant policy shift aimed at stabilizing the cedi. These restrictions, coupled with the cedi’s recent appreciation and other contributing factors, are expected to have a notable impact on individuals and businesses operating in Ghana. The future of the cedi and the effectiveness of these new measures remain to be seen, but they undoubtedly mark a new chapter in Ghana’s economic management. The introduction of these dollar withdrawal restrictions in Ghana is a key development to watch.

Image Source: MYJOYONLINE