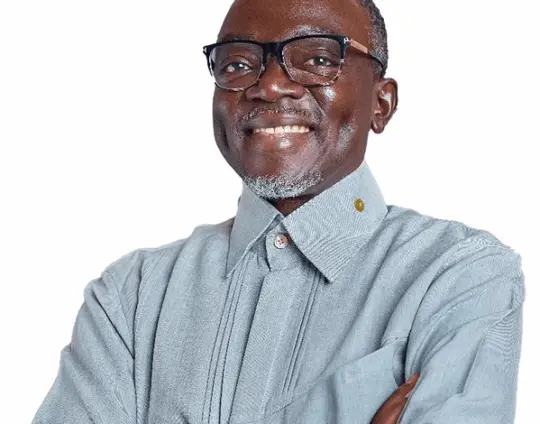

Ghana, long considered a prime destination for mining investment in Africa, is facing an unexpected challenge. Exploration companies, the lifeblood of the industry, are increasingly looking elsewhere, drawn by more favorable tax regimes in countries like Kenya and Côte d’Ivoire. This shift, detailed in a recent JoyNews interview with Ahmed Dasana Nantogmah, Acting Chief Executive of the Ghana Chamber of Mines, casts a shadow over the future of Ghana’s mining sector. Nantogmah’s concerns highlight how specific tax measures are impacting investment decisions, potentially leading to long-term economic consequences. The central question is whether Ghana can adapt to retain its competitive edge as a mining investment destination, or if it will cede ground to its regional rivals.

At the heart of the issue lies Ghana’s tax policies, specifically the imposition of a 3% levy on gross production and the application of VAT on exploration activities. These measures, according to the Ghana Chamber of Mines, are proving to be significant deterrents. “We’re losing to Kenya and Côte d’Ivoire because of bad tax policy,” Nantogmah stated, emphasizing the direct impact of these policies on investment decisions. The VAT on exploration is particularly burdensome, as it increases the financial risks for companies already investing heavily in uncertain ventures. As Nantogmah explained, companies might invest $10 million in exploration without making a significant discovery, yet they are still obligated to pay VAT, which is often non-refundable.

The result is a concerning exodus, with exploration companies redirecting their investments to Kenya and Côte d’Ivoire. In these countries, the absence of VAT on exploration creates a more predictable and financially viable environment. Nantogmah underscored this point, noting, “They are moving to places like Kenya and Côte d’Ivoire, where they don’t pay this VAT.” This shift highlights a critical loss of competitiveness for Ghana, as it struggles to attract the crucial early-stage investments that drive future mining projects. The current policies are creating an environment where Ghana is losing its attractiveness as a mining investment destination.

The potential long-term consequences for Ghana’s mining industry are significant. A decline in exploration activity inevitably leads to fewer new discoveries. Nantogmah warned that if this trend continues, Ghana risks losing out on the next generation of mining projects. Existing mining operations could eventually face decline due to the lack of new projects in the pipeline. Beyond the immediate financial impact, there is a risk of eroding investor confidence, making it even more challenging to attract future investment.

The Chamber of Mines is advocating for immediate action, urging the government to urgently review these tax measures, particularly the VAT on exploration. This review is deemed essential to prevent further loss of investor confidence and to ensure the long-term sustainability of Ghana’s mining sector. Targeted incentives, similar to those offered by Kenya and Côte d’Ivoire, could also play a crucial role in attracting and retaining mining companies. “This is not just about money, it’s about the future of Ghana’s mining industry,” Nantogmah emphasized, highlighting the broader implications of the current situation.

Ghana’s mining sector stands at a critical juncture. The Ghana Chamber of Mines has made it clear that current tax policies are incentivizing mining investment to flow towards more attractive destinations like Kenya and Côte d’Ivoire. The imposition of VAT on exploration and a 3% levy on gross production are key factors that are undermining Ghana’s competitiveness as a mining investment destination. Addressing these concerns through policy review and strategic incentives is essential to securing the future of Ghana’s mining industry and maintaining its position as a leading investment destination in Africa. The government’s response to these challenges will ultimately determine whether Ghana can retain its prominent status in the mining world or cede ground to its regional rivals.

Image Source: MYJOYONLINE