Accra, Ghana – In a significant boost to its economic outlook, Ghana has surpassed key reserve targets set under its International Monetary Fund (IMF) program, signaling a marked improvement in financial stability. Dr. Zakari Mumuni, the First Deputy Governor of the Bank of Ghana (BoG), revealed that the nation’s strategic approach to reserve management has not only bolstered confidence in the cedi but also positioned the country for sustained economic growth. The achievement underscores Ghana’s commitment to prudent financial practices, demonstrating its resilience in the face of global economic uncertainties. The success in exceeding IMF reserve targets reflects careful planning and effective strategies implemented by the central bank.

The original target set by the IMF was three months of import cover. Ghana has exceeded this benchmark, now standing at approximately 3.7 months based on IMF metrics. When accounting for petroleum funds, this import cover extends even further to 4.7 months, showcasing a robust buffer against external economic shocks. According to Dr. Mumuni, this milestone reflects the effectiveness of the central bank’s strategic interventions in the foreign exchange market.

“This tells you we’ve devised very innovative ways of meeting market demand while still accumulating buffers,” Dr. Mumuni stated in a recent interview, highlighting the central bank’s dual approach of supporting market needs while simultaneously building up reserves. This strategic balancing act has proven crucial in fostering confidence and stability within Ghana’s financial system.

The growth in Ghana’s reserves has had a tangible impact on the cedi, which is now demonstrating increased resilience. Market participants recognize the organic nature of this reserve growth, viewing it as a genuine indicator of economic strength rather than a temporary fix. The central bank’s actions are perceived as a sustainable strategy, avoiding the pitfalls of merely depleting reserves to artificially inflate the currency’s value, a move that often results in short-lived market rallies.

This milestone signifies a turning point for Ghana’s economy, suggesting a sustainable path forward. The enhanced reserves provide a critical buffer against external shocks, strengthening the country’s ability to meet its international obligations and attract foreign investment. As of the end of April, Ghana’s reserves had already exceeded $10 billion, with projections indicating a further increase to approximately $11 billion by the end of the second quarter. This performance surpasses initial expectations outlined under the IMF program.

A key aspect of Ghana’s reserve management is that these reserves are not debt-creating. “These are not debt-creating reserves,” Dr. Mumuni emphasized, underscoring the sustainable and organic nature of the country’s economic growth. This distinction is crucial, as it reflects a genuine strengthening of Ghana’s financial position, built on sound economic policies rather than increased borrowing.

In conclusion, Ghana’s success in exceeding its IMF reserve targets highlights the nation’s commitment to economic stability and responsible financial stewardship. This achievement, driven by strategic planning and innovative approaches to reserve management, positions Ghana for continued growth and resilience in an ever-changing global economy. As Ghana continues on this path, the increased confidence among investors and market players will undoubtedly pave the way for further opportunities and sustained economic prosperity.

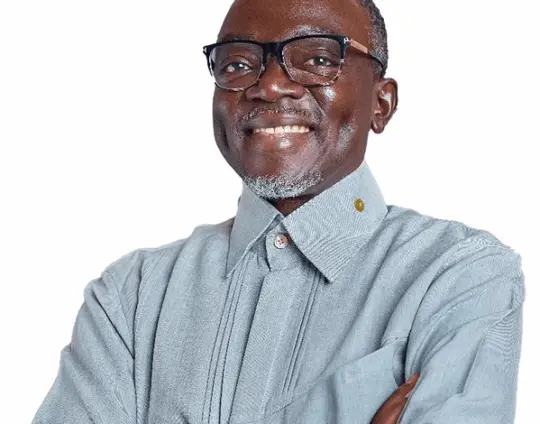

Image Source: MYJOYONLINE